Your problem is that you are not addressing 80% of your problem.

What do I mean by that?

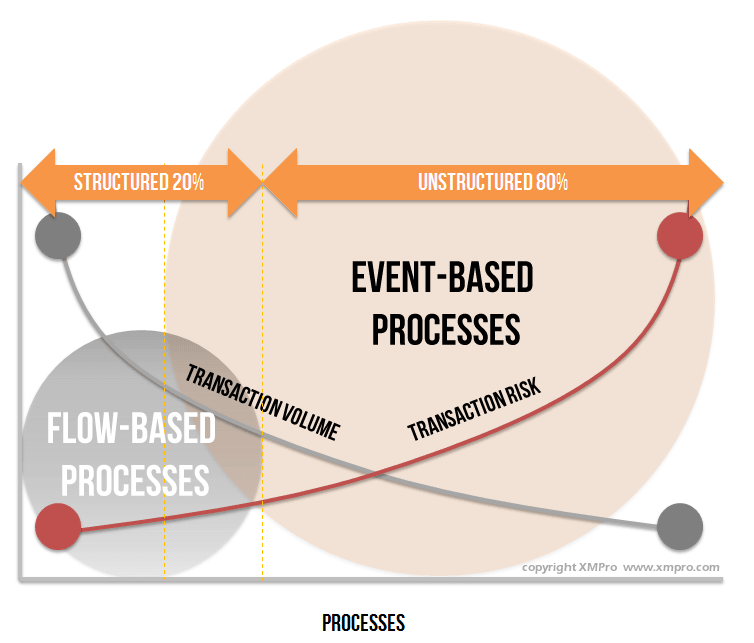

Your problem is not really the 20% of the work, where we know the process flow, which handles 80% of the transactions in your organization. It is the 80% remaining work, where we rely on people and we don’t know the flow upfront, which accounts for 20% of your business transactions.

This is the work that happens on the right hand of the graph. The challenge is that transactional risk is the inverse of the transactional volume. This means that the RISK PER TRANSACTION is much higher on the right hand side.

Let’s take a simple example. Withdrawing cash at an ATM machine is a highly predictable process with a small number or process variations but it accounts for millions of transactions per day in most medium to large banks. These are the processes on the left of the curve. They are generally well supported by Line of Business (LOB) applications and all the potential options are well defined and mapped into the business process flow.

If the ATM system goes down for a few hours and the bank loses $10m as a result, the transactional risk is still only a few cents per transaction. And it doesn’t happen often. These failures are systemic and generally addressed with high urgency. These processes are also very well defined and all the potential variations are built as pre-defined flows in the line of business applications. We have control of the structured processes in the business.

It is the unpredictable processes on the right that have the high transactional risk. In our banking example it is the private client on-boarding that may have a very low transaction volume but a very high transactional risk. The process path is unpredictable, even though there are a finite number of events that can occur. The customer will partly dictate how the process evolves and much of the routing and decisions are made by senior relationship (case) managers based on experience, knowledge and intuition. Peter Drucker called it “knowledge work”.

Just imagine the impact of process failure in this example. The risks for this process can be fiscal but also brand damage and legal or compliance risk.

Mortgage applications and derivate trades are other banking examples. There are many more in ALL ORGANIZATIONS and it can account for 80% of work done.

These processes rely on people to make decisions that cannot be built into pre-defined flows. But this does not mean that we don’t have control.

The process flows are unpredictable but not unidentifiable. We may not know in advance how a specific transaction may evolve, but we do know how to identify most, if not all, of the potential events that can happen.

Managing unpredictable processes require moving away from trying to define the process flow for these “knowledge-style” processes. It requires an event-based approach rather than a workflow-based approach where we recognize that the “machine” cannot make decisions for these processes. It is best left to people to make the right decisions and determine the process flow based on their knowledge, experience and intuition.

The best you can do is to provide them with the best decision support possible during the course of the process. Also allow them to have multiple process options that support unstructured but not uncontrolled processes. Let them work inside a governance framework, connect them to the existing Line of Business applications and let them service those unpredictable customers to get predictable results.

XMPro’s iBOS (Intelligent Business Operations Server) is an event-based iBPMS that reduces uncertainty and risk.

Our iBOS gives (Operations) Managers control by:

- Allowing processes to evolve on a case-by-case basis within a governance framework;

- Providing decision support for people that make decisions that determine the eventual outcome of the process; and

- Capturing critical social conversations and collaboration in these unstructured processes as part the audit trail of each process transaction.

We typically integrate these processes with the other systems in your business and become the glue that keeps it all together. It is even “backward-compatible” to those structured processes if you want to put it all in one Intelligent Business Operations Server.

Research by the leading analyst firms like Gartner and Forrester shows that you can get more than 30% efficiency gain by managing the 20% structured processes in your business. Just imagine what you can achieve by managing the 80% unpredictable, unstructured ones.